Key Takeaways

- Learn typical holiday let start‑up costs, running costs and hidden expenses.

- Understand how to budget for your holiday home, cashflow and pricing to stay profitable.

- See how holiday let software helps manage costs and grow your revenue.

Starting a holiday let business is exciting, but working out the real holiday let costs can feel overwhelming. Between start‑up costs, running costs and unexpected expenses, it’s easy to lose track of your budget.

This guide breaks down the key holiday home costs and gives you practical tips to plan, price and manage your holiday rental more confidently.

You don’t need to be a finance expert to run a profitable holiday let – you just need a clear view of your costs, your prices and your goals.

Holiday let costs: Start-Up, running costs and budgeting tips

New to the business? You’ll be wondering, “what is the cost of running a holiday let?”

Depending on where your business is registered and where your properties are located, there will be different costs to consider. It requires careful research.

12 Costs of running a holiday letting business

1. Complying with local licence and planning requirements

2. Safety checks and upgrades

3. Business costs

4. Property costs: Basics

5. Property costs: Short term lets specific

6. Property Management Company

7. Attract bookings: Your Own Website

8. Attract bookings: Advertising

9. Manage your bookings

10. Managing guests needs: Guest Communications

11. Cleaning and turnovers

12. Your time

1. Complying with local licence and planning requirements

- Licence - in some locations you are required to register properties with a local authority.

- Planning - you may also need planning permission.

- Visitor Levy - you may need to factor in charging guests for the Visitor Levy (also known as a tourist tax).

- DAC7 - you may need to provide data to your local council. Although data does not have an explicit cost, you may need to pay an accountant to organise your figures for submitting, or use a software that supports this.

2. Safety checks and upgrades

- Electrical Safety Tests - Electrical Installation Condition Report (EICR), Portable Appliance Tests - (PAT Testing)

- Gas tests

- Legionella tests

- Oil Safety Certificate

- Fire Risk Assessments and Smoke Alarm fittings

- Carbon Monoxide assessments and detector fittings

- Safety Risk Assessments

3. Business costs

- Business rates, council tax, and other taxes relevent to your local area

- VAT or Sales Taxes / Occupancy taxes

- Professional Indemnity insurance

- Buildings insurance

4. Property costs: Basics

- Mortgage or Loan payments

- Utilities

- Electricity

- Gas

- Water and Sewerage

- Parking permits

- Waste removal

- Internet access (wifi)

- Cable TV

5. Property costs: Short term lets specific

- Furnishing improvements for fire and safety compliance

- Redecoration

- Breakages and damage

- Linen cleaning and replacements

- Guest supplies, eg toilet paper and washing up liquid

- Welcome baskets for holiday lets

- Window cleaning

- Landscaping

- Hot tub, BBQ and Pool cleaning

6. Property Management Company

Typically there are two types of service Property Management Companies or Agencies offer:

- Marketing: work on your behalf to attract bookings

- Full Service: manage all aspects of your rental

7. Attract bookings: Your Own Website

At some point (the earlier the better) you will want to attract direct bookings. Your own website may cost something to build and almost certainly a monthly fee to host.

- An Instant website

- Buildable website

- Custom website

8. Attract bookings: Advertising

- Booking fees (also known as platform service fees) payable to each channel eg Airbnb

- Channel manager fees payable to a software that makes it easy to connect your properties with multiple channels

- Advertising costs, eg Newspaper adverts

- Social media adverts, eg Facebook

9. Manage your bookings

- Spreadsheet

- Free (e.g. the free version of Bookster)

- Paid: property management software provider, eg Bookster

10. Support guests needs: Guest Communications

e.g. Booking confirmations, sending key codes, replying to messages and newsletters.

You may wish to pay for a system or service that helps you with these communications.

Bookster has automated messages, an Email Marketing tool and a Guest area.

11. Cleaning and turnovers

After each booking, you will need to clean the property and change all the laundry.

You will need to account for:

- Sheets and towels

- Cleaning products

- Welcome pack items

12. Your time

One aspect that is often overlooked is the cost of your time. As the founder of your business it is likely that you'll be wearing many hats, working long hours, and cover the big picture as well as the finer details of your business.

This has a cost.

Your time is valuable.

Track how long you spend on activities, such as emailing guests, and then look for tools that can do the heavy lifting for you, leaving you time to focus on the more personal touches.

Planning your holiday let costs with confidence

If you’re just starting a holiday let business, it’s completely normal to feel unsure about what your real costs will be.

You may be hearing different numbers for holiday let start‑up costs, running costs and “hidden” expenses, and it can be hard to know what’s realistic for your holiday home.

Instead of trying to predict everything perfectly from day one, focus on building a simple, flexible budget.

Split your holiday let costs into three buckets: set‑up costs (furnishing, safety checks, photography), ongoing running costs (cleaning, utilities, subscriptions, insurance, marketing) and repairs or replacements when things wear out.

This helps you see the full picture of what it really costs to run a holiday rental all year round.

Turning your costs into a holiday let budget

Once you’ve listed your main holiday home costs, the next step is turning those into a simple budget and cashflow plan.

Start by asking two questions: How many weeks do I realistically expect to book each year? and What average nightly rate do I need to cover my expenses and still make a profit?

From there, you can test different scenarios: a conservative year, a normal year and a busier year. This kind of planning helps you decide whether to invest in upgrades (like new furniture or a hot tub), when to run promotions, and how to set minimum stays or seasonal pricing.

It also gives you a calm reference point when bills go up or bookings slow down, because you can see how your holiday let running costs and income balance out across the year.

Using software to track holiday let expenses

Trying to manage holiday let expenses in a notebook or a handful of spreadsheets quickly becomes stressful, especially if you’re juggling more than one property.

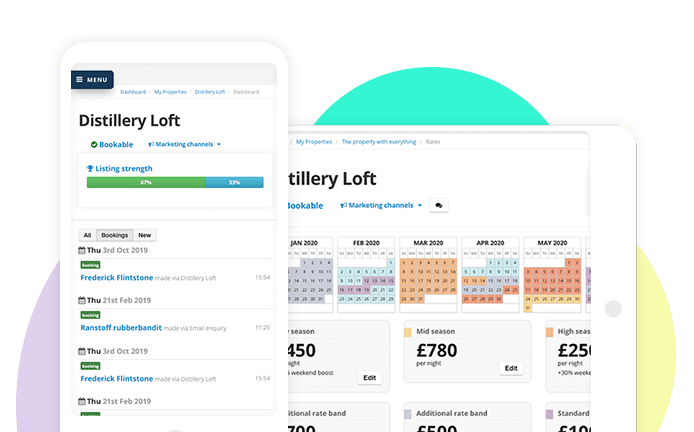

A good holiday rental system can help you bring everything together in one place from bookings, income, fees and key running costs, so you can see if your holiday rental business is on track.

Look for tools that let you export accounting data and compare your revenue in analytics tools to your main holiday home costs over time.

This kind of visibility makes it easier to tweak your pricing, cut unnecessary spending and spot where your profits are really coming from.

Even if you only have one cottage or apartment, starting with simple tracking now will make your life much easier as your business grows.

You don’t have to figure holiday let costs out alone

Working out the true costs of running a holiday let is a learning curve and you don’t have to get it perfect in the first year.

Many successful owners started with a basic budget, then adjusted as they saw real bookings, real bills and real guest behaviour.

If you’re unsure whether your pricing is high enough to cover your holiday let running costs, or you’re worried about specific expenses, reach out for help.

Industry bodies like the ASSC in Scotland and PASC in England and Wales, local holiday rental communities and your property management software team can all share guidance, examples and tools to help you understand your numbers.

With the right support, you can move from guessing at your costs to feeling more confident in your holiday rental business decisions.

Frequently Asked Questions

- What are the main start-up costs of a holiday let?

- Typical holiday let start‑up costs include furnishing and decorating the property, safety equipment and checks, professional photography, initial marketing, and any legal or licensing fees required in your area.

- How can I estimate the running costs of a holiday rental?

- To estimate holiday let running costs, list regular expenses such as utilities, cleaning, laundry, subscriptions, insurance, maintenance, marketing and platform fees, then spread them across a full year to see how much income you need to cover them.

- How often should I review my holiday home budget?

- It’s sensible to review your holiday home budget at least once per quarter, checking whether your bookings, nightly rates and costs are still aligned, and adjusting your pricing, promotions or spending if your running costs have changed.

Getting clear on holiday let costs is one of the most important steps in building a sustainable, profitable holiday rental business.

With a simple budget, the right tools and some support along the way, you can understand your expenses, price with confidence and focus on giving guests a great experience.