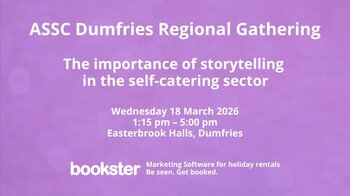

Bookster will be joining the ASSC and its members at the event in Dumfries on 18 March 2026.

3 min read

Bookster joins PASC UK to strengthen support, insight and advocacy for self‑caterers, alongside our ongoing partnership with the ASSC.

4 min read

Choose the right direct booking website for your holiday let without overspending or losing control.

3 min read

Stay compliant with DAC7 and UK digital reporting, without drowning in admin.

3 min read

Understand Airbnb’s 15.5% host fee, adjust your prices with confidence, and protect your profit.

1 min read

Turn your holiday rental website into a simple, high-performing hub for direct and repeat bookings.

3 min read

Turn happy Airbnb stays into loyal, direct-booking guests with simple, memorable touchpoints and offers.

2 min read

Bookster will be joining the ASSC and its members at the event in Dumfries on 18 March 2026.

2 min read

Introducing the Visitor Levy Uplift / Tourism Tax tool to display and collect additional amounts due.

2 min watch

Bookster and Turno team up to cover techniques to boost guest trust, loyalty and revenue.

1 min read

Use Bookster to sync up your Airbnb and Booking.com property listings.

4 min read

Earn a higher revenue, and grow your profit through attracting holiday-makers with dogs, through careful planning and marketing.

3 min read

Why do Bookster include Schema.org markup on Bookster websites?

3 min read

Ben of Lighthouse Keepers Cottage in Noss Head shares her advice on making your holiday home business more environmentally friendly.

10 min watch

Natalie Clayton and Sadie Rowell introduce AA Visitor Ready and Quality grading for self-catering homes in the UK.

3 min read

Ben of Lighthouse Keepers Cottage in Noss Head shares advice on emailing your guests.