Key Takeaways

- Bookster is introducing a Visitor Levy Uplift / Tourism Tax from 29 September 2025

- The levy can be a customisable % or fixed amount for the full or part of the booking length.

- Add your levy under Settings / Add Ons / Mandatory Add on

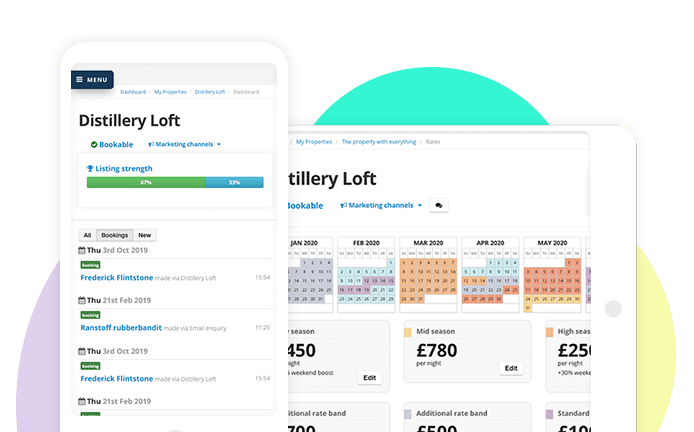

Bookster is pleased to announce the launch of a new feature that enables hosts to easily add an amount to accommodation prices, which can be used to charge a visitor levy (also known as a tourism tax) directly to their guests.

Bookster helps ensure hosts remain compliant while providing guests with a clear, professional booking experience.

New feature: Visitor Levy Uplift / Tourism Tax Tool

Bookster is introducing a Visitor Levy Uplift / Tourism Tax feature that adds a customisable percentage or fixed amount for part or the full length of the booking duration, directly to their prices.

This new functionality will be found in all Bookster accounts under:

Settings → Add Ons → Mandatory Add On

By setting up a Visitor Levy Uplift, you can:

- Add the estimated required charge automatically to every booking.

- Clearly display the fee to guests at the time of booking, or choose not to display this fee but incorporate it into the prices.

- Save time by removing the need to calculate and request the fee manually.

Training session

To help you set up this feature, we hosted a live training session. If you'd like the replay, please let us know.

The session covered:

- How to configure the estimated levy in your account.

- Practices for communicating this fee to guests.

- Practical examples on the options available.

- A live Q&A to answer your questions.

Next steps

Log into your Bookster account and explore Settings → Add Ons → Mandatory Add On.

This update is part of Bookster’s ongoing commitment to giving hosts practical, easy-to-use tools that reduce admin and improve transparency for guests.

Next steps for your council payment

Bookster plans to review the requirements for providing a report to your local council and will communicate developments closer to October 2026 when the first reports of Visitor Levy due are to be provided to Edinburgh Council.

Why this matters

Many regions are introducing mandatory visitor levies to support local infrastructure, cultural initiatives, or environmental protection.

By integrating this feature, Bookster helps ensure hosts remain compliant while providing guests with a clear, professional booking experience.

Background of the Edinburgh Visitor Levy

The Edinburgh Visitor Levy is Scotland’s first formal Levy, on overnight stays, enabled by the Visitor Levy (Scotland) Act 2024.

Following extensive consultations, Edinburgh City Council formally approved a scheme in January 2025 that charges 5% on paid overnight accommodation capped at the first five consecutive nights.

This legislation will affect hotels, B&Bs, self-catering lets, hostels, within the City of Edinburgh boundaries from 24 July 2026.

Bookings made on or after 1 October 2025 for stays from that date forward will be subject to the levy.

Other city councils are reviewing the options to introduce their levy, with formal consultations in process.

Bookster has introduced a Visitor Levy / Tourism Tax tool as part of the Mandatory Charges section of the Add Ons.

This is available to all Bookster clients, and will display the estimated Visitor Levy amount due by the guest, at the time of booking.